In this section you will find detailed information regarding the Evotec SE share, such as basic share data over share price summary, stock price and charts, shareholder structure, our financial analysts and their latest recommendations, and our dividend policy.

Listing on NASDAQ

Since November 2021 Evotec SE is listed on NASDAQ (Ticker Symbol: EVO).

Please find all further information regarding the NASDAQ listing as well as all published filings of Evotec SE here.

Stock Price & Chart

On 30 July 2025, the number of total voting rights amounted to 177,766,541.

Under the German Securities Trading Act (Wertpapierhandelsgesetz, WpHG), shareholders of a listed German company are required to notify the Company and the German Federal Financial Supervisory Authority (BaFin) of any change to the voting interest in Evotec SE whenever it reaches, exceeds or falls below specified thresholds (3%, 5%, 10%, 15%, 20%, 25%, 30%, 50% or 75% of the voting rights). Evotec’s voting rights announcements can be found here.

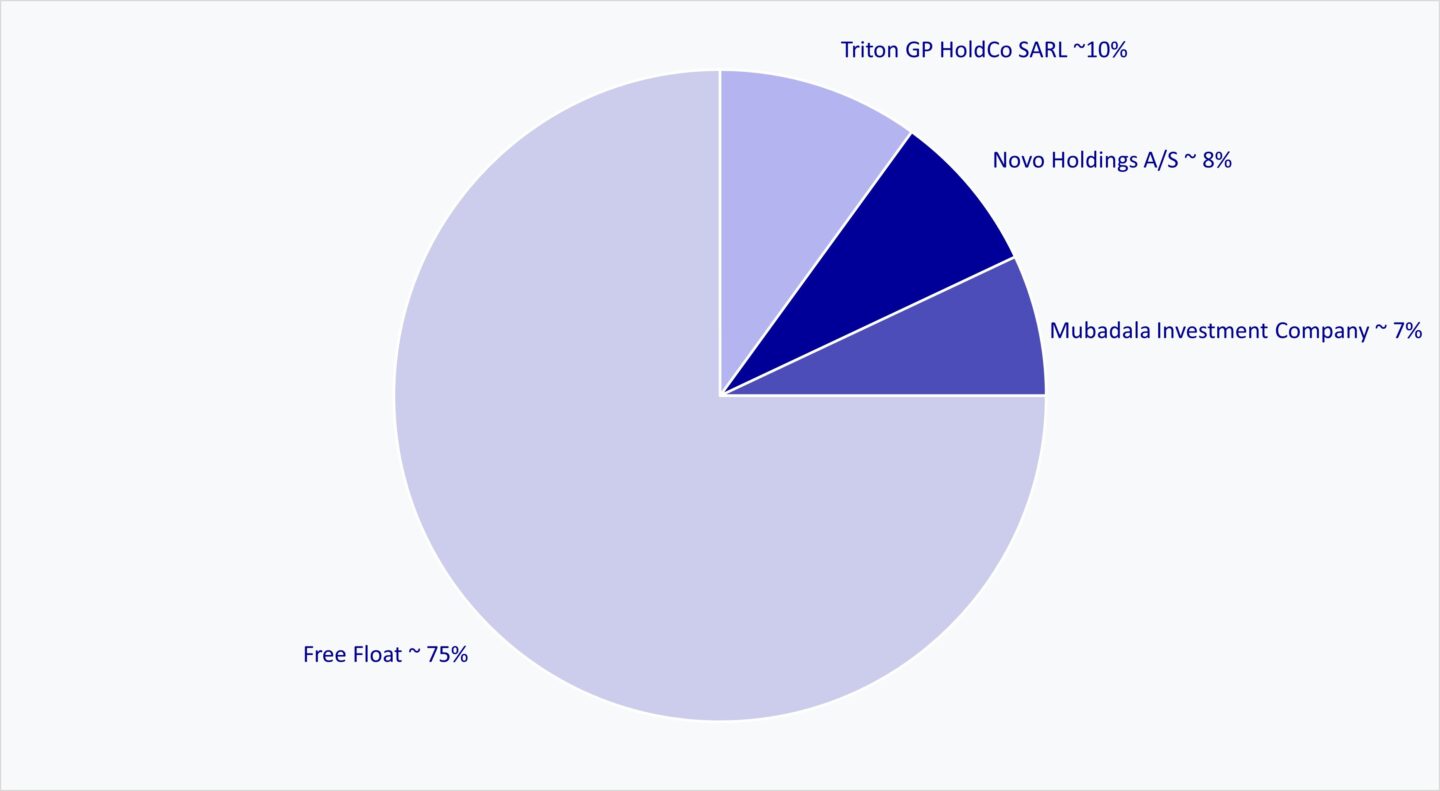

Three shareholders, Novo Holdings A/S, Mubadala Investment Company and Triton GP HoldCo SARL, currently hold more than 5% of the shares of Evotec SE. The free float according to the definition of the Frankfurt Stock Exchange is approx. 75% according to our estimates (Evotec: 07|2025).

Rounding differences may occur.

Analysts

Overview of analysts covering the Evotec share.

Latest Analyst Recommendations

Important Notice:

Evotec is covered and evaluated by the analysts mentioned above. Please note that any opinions, estimates or forecasts regarding Evotec's performance made by these analysts are theirs alone and do not represent opinions, estimates or forecasts of Evotec or its management. The above reference to the analysts does not imply that Evotec endorses their opinions. Evotec is under no obligation to update or supplement the information provided above and does not guarantee the accuracy or completeness of this list.

Copies of the reports from the analysts listed above can be obtained directly from the analysts or their employers. Due to legal requirements, Evotec is not allowed to publish the analyst reports.

Evotec's Dividend Policy

The payment of dividends depends on Evotec’s financial situation and liquidity requirements, general market conditions, and statutory, tax and regulatory requirements.

Evotec has never paid or declared any cash dividends on its ordinary shares, and does not anticipate paying any cash dividends on its ordinary shares in the foreseeable future. Evotec intends to retain all available funds and any future earnings and reinvest them in the company’s further growth strategy to better leverage long-term growth and sustainability.

Under German law, Evotec may pay dividends only from the distributable profit (Bilanzgewinn) reflected in its unconsolidated financial statements (as opposed to the consolidated financial statements for Evotec and its subsidiaries) prepared in accordance with the principles set forth in the German Commercial Code (Handelsgesetzbuch) and adopted by the Evotec Management Board (Vorstand) and the Supervisory Board (Aufsichtsrat), or, as the case may be, by the shareholders of Evotec in a general shareholders’ meeting. In addition, under German law Evotec may not pay dividends before annual profits exceed the losses carried forward.

All of the shares represented by the ADSs offered in USA generally have the same dividend rights as all of Evotec's other outstanding shares.